I have written a few things about the 2006 Tory budget here and here. But I am trying to analyze how some of the savings affect the average Joe like me. I will try to put one or two of these up a day as I work through reading the budget.

DISCLAIMER:I am not an accountant and do not profess to be. If anyone out there can correct me if I am way off base please do. If I am off by a few dollars here or there, oh well. It’s close enough for guesstimating.

The Canada Employment Credit is the item I want to talk about today.

The new Canada Employment Credit – a tax credit on employment income of up to $500, effective July 1, 2006, to help working Canadians. The eleigible amount will double to $1,000 as of January 1, 2007.

What does this mean? Well first off, it only applies to Employment income. i.e. it is for those who are WORKING!! If you sit at home riding the dole, or welfare or any other form of non employment income, this is not for you. To take advantage, go get a job. What a concept.

Secondly, it is $500 for the latter half of this year which does equate to a $1,000 a year right away, it just happens to start halfway through the year.

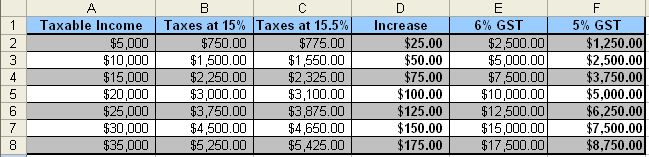

But let’s compare this in a chart that shows how this compensates for the increase in the lowest tax bracket rate from 15.5% to 16%.

Taxable

Income |

Taxes at

15.5% |

Taxes at

16% |

Increase |

CEC

Reduction |

Net? |

| $5000 |

$775.00 |

$800.00 |

$25.00 |

$160.00 |

+$135.00 |

| $10000 |

$1550.00 |

$1600.00 |

$50.00 |

$160.00 |

+$110.00 |

| $15000 |

$2325.00 |

$2400.00 |

$75.00 |

$160.00 |

+$85.00 |

| $20000 |

$3100.00 |

$3200.00 |

$100.00 |

$160.00 |

+$60.00 |

| $25000 |

$3875.00 |

$4000.00 |

$125.00 |

$160.00 |

+$35.00 |

| $30000 |

$4650.00 |

$4800.00 |

$150.00 |

$160.00 |

+$10.00 |

| $35000 |

$5425.00 |

$5600.00 |

$175.00 |

$160.00 |

-$15.00 |

The break even point happens to be $32,000. So all you lefty Dippers bitching about this taking money out of the poorest peoples hands. You can all stick it in your ear. Anyone earning under $32,000 will come out ahead. Anyone working from $32,000 and above will see a slight increase. Since we have a progressive tax system, anyone earning above $32,000 will be very slightly behind. This level flattens at about $36,368 (or $37,358 for sticklers who want the $1,000 taken into account). At this point anyone making over this amount would be dropping an extra $21.84 into the public purse.

i.e. it hits those making more and benefits those making less provided it is employment income. I have to stress this point again.

I personally am tossing in the $22 bucks. To make this up, I will have to buy $2200 in GST taxable goods this year, or $1100 in GST taxable goods when the full cut is implemented to make it up. I am pretty sure I far exceed this which should put me in the black.