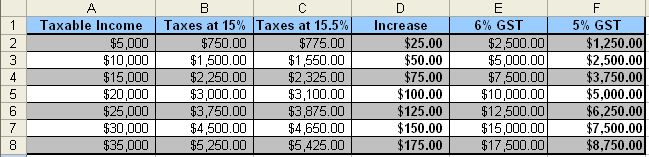

I must preface this by saying that I am not an accountant. Nor do I profess to be a tax expert of any kind. But I am not that far off with the following chart. It indicates what your tax increase may be with the clawback of the Liberal Income Tax cut for the lowest tax bracket.

In simpler terms. The increase from 15% to 15.5% on the tax rate for income that goes to approximately $35,000. (After that I think you go up to the next bracket.

As you can see, for someone making $25,000, the increase will be about $125. For many with one or more children under 6 in the household, you come out far ahead with the $1200 Universal Child Care payment.

In fact, I even calculated how much GST taxable goods and services you would need to buy at a 6% GST and a 5% GST to counter the approximate income tax increase. Most may not spend 50% of their income on GST taxable goods, but you probably do spend 25% of your income on these things which means once it hits 5% you should be far ahead.

Jim Flaherty put it this way. The Liberals taxed us too much. He took $2 out of every $3 that we were being overtaxed and gave it back to us. That’s why this goes all over. It is to make sure every Canadian gets some relief or help in some way.

Pingback:

Notice: Only variables should be assigned by reference in /var/www/wp-content/plugins/subscribe-to-comments/subscribe-to-comments.php on line 591

OfficiallyScrewed.com » Layman’s Budget Part 1 - CEC