DISCLAIMER:I am not an accountant and do not profess to be. If anyone out there can correct me if I am way off base please do. If I am off by a few dollars here or there, oh well. It’s close enough for guesstimating.

From The Budget In Brief, page 9.

A children’s fitness tax credit for up to $500 in eligible fees for physical fitness programs for each child under age 16.

I am going to quote an accountant friend of mine on this tax credit. He said:

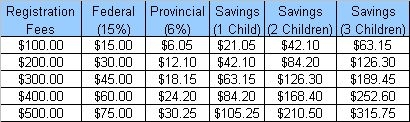

A tax credit generally is only a flat rate reduction of income tax of 15% federal and 6.05% provincial, the lowest marginal tax rates, or $110 in this example. It is the same type of deduction as a summer camp or caregiver.

So what does this mean to you? Let me show my my handy dandy table to give you an idea on what it may mean for you.

Now as I have blogged on numerous occasions, the Better Half and I have a couple of active children, ages 9 and 13. I am not positive of the total we spend on their athletic registrations but it is definately over $500 for one and close to it for the other. This means that the new credit will put about $200 back in my pocket.

Thanks Mr. Flaherty. That’s just enough money to get my son a new pair of soccer shoes and pay for one night hotel’s stay when my daughter competes at Provincials later in the month. Or perhaps I could take that savings and buy my kids an RESP!! (I learned that one from reading Brent Colbert) Apparently it shelters the growth from taxes and triggers a matching amount from the government. How sweet is that to have tucked away when the kids apply to post-secondary education?

I hope Canadians are paying attention.